how to pay indiana state taxes quarterly

Based On Circumstances You May Already Qualify For Tax Relief. Ad Stand Up To The IRS.

/cloudfront-us-east-1.images.arcpublishing.com/gray/DF7ALKM5DNCS7DZYIXTI7QR4B4.jpg)

Quarterly Payments Could Help Lessen Impact Come Tax Time

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest.

. Under non-bill payments click your payment method of choice. Estimated payments may also be made online through Indianas INTIME website. Claim a gambling loss on my Indiana return.

If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. Be sure to denote that you are making an individual income tax payment. Talk with Our Experienced Staff About Your Taxes.

Cookies are required to use this site. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. This means you may need to make two estimated tax payments each quarter.

Ad Learn What Your Tax Liability Could Be. Page Last Reviewed or Updated. Have more time to file my taxes and I think I will owe the Department.

Withholding and tax credit will not be less than. Any employees will also need to pay state income tax. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

Personal Income Tax Payment. Indiana Small Business Development Center. 16 hours agoHeres an overview of the process.

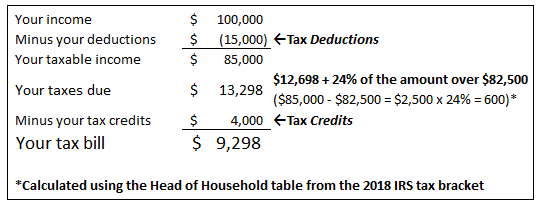

Department of Administration - Procurement Division. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Tally Up Your Income.

Find Indiana tax forms. Bank or credit card. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

Easily Download Print Forms From. Your tax projection exceeds 1000 after removing withholding and tax credits during tax return filing. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Realty Transfer Tax Payment. Follow the instructions to make a payment. Take the renters deduction.

The Indiana income tax rate is set to 323 percent. Know when I will receive my tax refund. However some counties within Indiana have an additional tax rate making the combined tax rate ranging from 373 percent to 613 percent.

Ad Manage exemption documents calculate rates apply custom rules generate reports. Put together all of your Form 1099-NECs to add up your total nonemployee compensation. If you dont receive 1099s or if you.

Blank Forms PDF Forms Printable Forms Fillable Forms. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. QuickBooks Self-Employed calculates federal estimated quarterly taxes.

90 of the quarterly estimated tax for the year 2022. Ad quarterly tax payment schedule. Tom Wolf Governor C.

Avalaras pre-built Infor integration makes getting started easier. Line I This is your estimated tax installment payment. 100 of the tax shown in the 2021 federal tax return as long as it covers all 12 months.

As a reminder Heard cannot submit estimated tax for you and you are responsible for paying in a timely manner. Quarterly tax payment schedule. You can check specific county rates listed by the Department of Revenue.

Pay my tax bill in installments. Some states also require estimated quarterly taxes. If this is not valid refer only to the 90 rule.

Your browser appears to have cookies disabled. One to the IRS and one to your state.

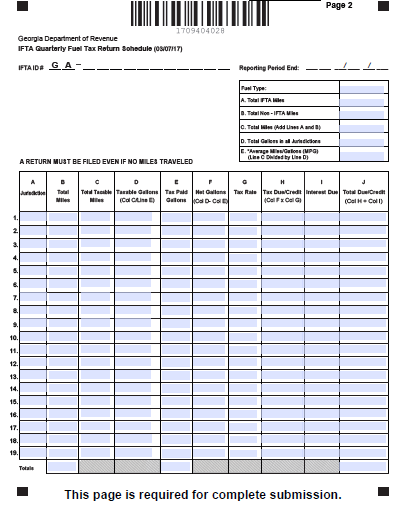

Fuel Permits Ifta Permit Temporary Ifta Permits

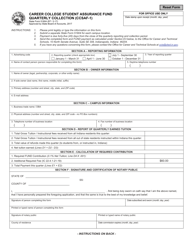

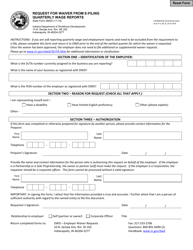

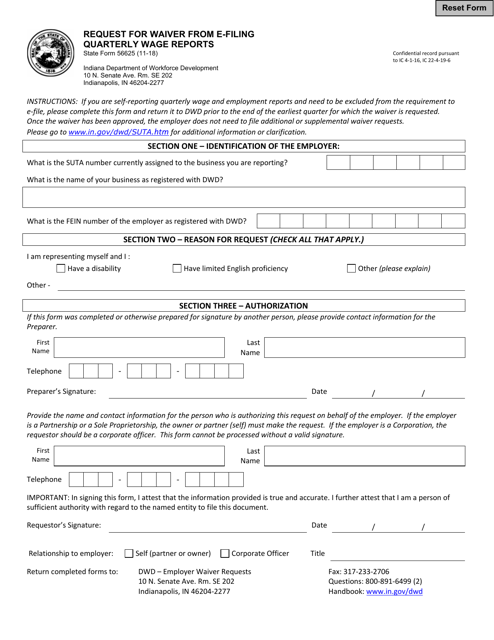

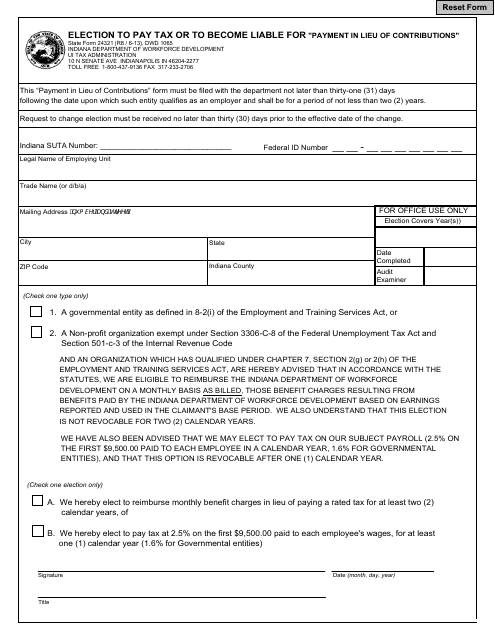

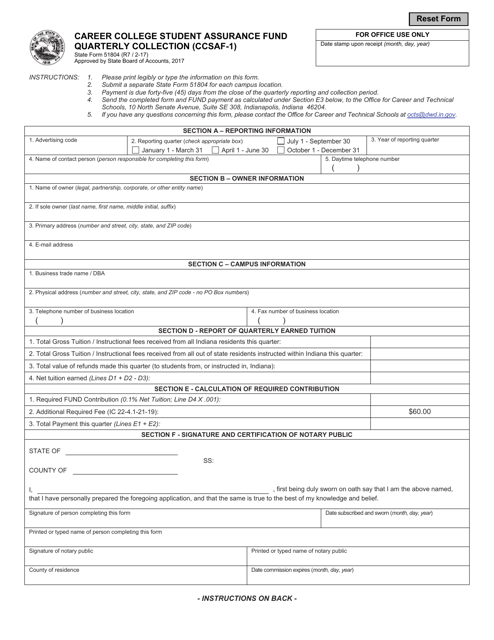

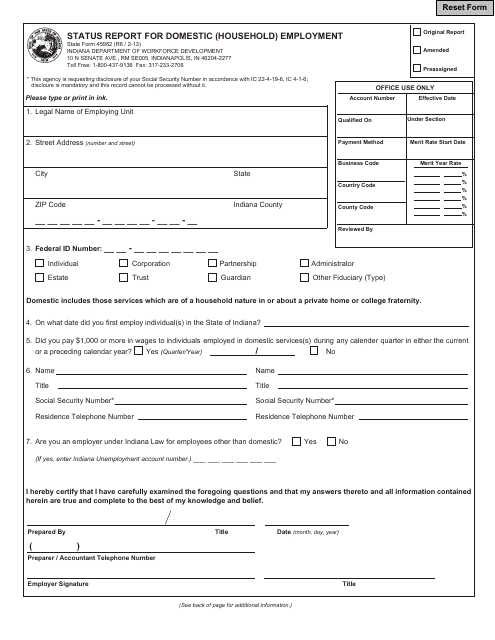

Indiana Department Of Workforce Development Forms Pdf Templates Download Fill And Print For Free Templateroller

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Indiana Department Of Workforce Development Forms Pdf Templates Download Fill And Print For Free Templateroller

Do Large Corporate Tax Cuts Boost Wages Evidence From Ohio

Indiana Department Of Workforce Development Forms Pdf Templates Download Fill And Print For Free Templateroller

Region Steel Mills Pay Out Up To 14 515 In Profit Sharing Bonuses For Fourth Quarter Northwest Indiana Business Headlines Nwitimes Com

How To Streamline Quarterly Ifta Reporting For Your Fleet

Indiana Department Of Workforce Development Forms Pdf Templates Download Fill And Print For Free Templateroller

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax Return

Indiana Department Of Workforce Development Forms Pdf Templates Download Fill And Print For Free Templateroller

Indiana Department Of Workforce Development Forms Pdf Templates Download Fill And Print For Free Templateroller

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Federal And State Payments Electronic Funds Withdrawal Setup